-

Economic Perspectives

Trade with China:

Part 1 of 2

June/July 2024

- Filename

- Economic Perspectives JUNE 2024.pdf

- Format

- application/pdf

TRANSCRIPT

With the presidential election just a few months away, one of the key topics that's on everyone's mind is trade policy, especially with China. This issue is not just a matter for politicians, but it appeals to all of us regardless of our political affiliation.

The two key candidates have been engaging in a robust discussion about protectionist trade strategies, which marks a significant departure from the free trade policies that have been the norm of our domestic trade policy for many decades.

This video segment is the first of two presentations on U.S. trade with China. In this first part, we will delve into China's economic growth over the past few decades and how their economy has become intertwined with ours. However, the real meat of our discussion, the contemporary trade issues being debated in the upcoming election, will be presented in the second part to be released at the end of July.

But for China's economy, it's been growing ever since 1978 – that's when a significant change happened. After decades of state control of all its productive assets, the government embarked on a major economic reform program. It liberalized foreign trade and investment. It relaxed state control over many parts of the economy and invested in industrial production, innovation in transportation, technology, and also the education of its workforce, all to become the world's largest producer of manufactured goods.

Let's take a look at some of the charts.

Chart 1: China Foreign Trade Exports

trillions, CNY

Data current as of June 26, 2024

Sources: Customs General Administration, People’s Republic of China

Information is subject to change and is not a guarantee of future results.

Chart 1 1:47– This chart shows total exports from China since 1980. You can see how exports started to pick up in the early 1990s. The primary catalyst for increasing exports was a 33% devaluation in China's currency in January 1994. This reduced the price of most of China's exports, which brought about higher levels of exports, and these lower-priced goods started to flood the U.S. market.

Exports got another boost when China joined the World Trade Organization. China agreed to several reforms, which gave them access to new trade partners. In the 1990s as well as into the 2000s, lower-price manufactured imports were very attractive to U.S. consumers. Economically, it helped to keep inflationary pressures contained despite the low level of unemployment.

Many companies could cut costs and boost profits by transferring their products manufacturing to a land where wages were low and unions were banned. When the Chinese products were sold to the U.S., they were paid for in U.S. dollars. To help keep the exchange rate relatively stable, China kept the proceeds from those sales of goods in U.S. dollars and bought U.S. treasuries. This helped keep interest rates low.

Chart 2: Treasury Debt Heald by China

$, USD, billions, % of total foreign holders

Data current as of June 26, 2024

Source: U.S. Treasury

Information is subject to change and is not a guarantee of future results.

Chart 2 3:07– In this chart, since 2000, the dark blue line shows that holdings in U.S. Treasury securities quickly escalated from near zero to a peak of $1.3 trillion in 2013. That accounted for almost 25% of the foreign debt holdings.

Since then, it has fallen to $771 billion. China has been reducing U.S. Treasury holdings like many other countries who do not want Western governments to have such control over global monetary policy issues, but that's another story for another time.

Chart 3: Chinese Renminbi (yuan)

price of 1 USD in CNY, inverted

Data current as of June 26, 2024

Source: Bloomberg

Information is subject to change and is not a guarantee of future results.

Chart 3 3:43– This chart shows the value of the currency since 1980. It is inverted, so when you see the dark blue line fall, it's representing a decline in the currency's value. You can see that the devaluation in 1994 was a very dramatic move. However, the start of the Asian financial crisis, which began in 1997 and wreaked havoc on economies in the region before spreading to Latin America and Eastern Europe, had no impact on the value of their currency.

When China joined the World Trade Organization at the end of 2001, exports exploded, yet the currency hardly budged. Since 2010, it has stayed within a very narrow range of six to seven yuan to the dollar. This is considered peculiar considering the massive growth of the economy during this period of time.

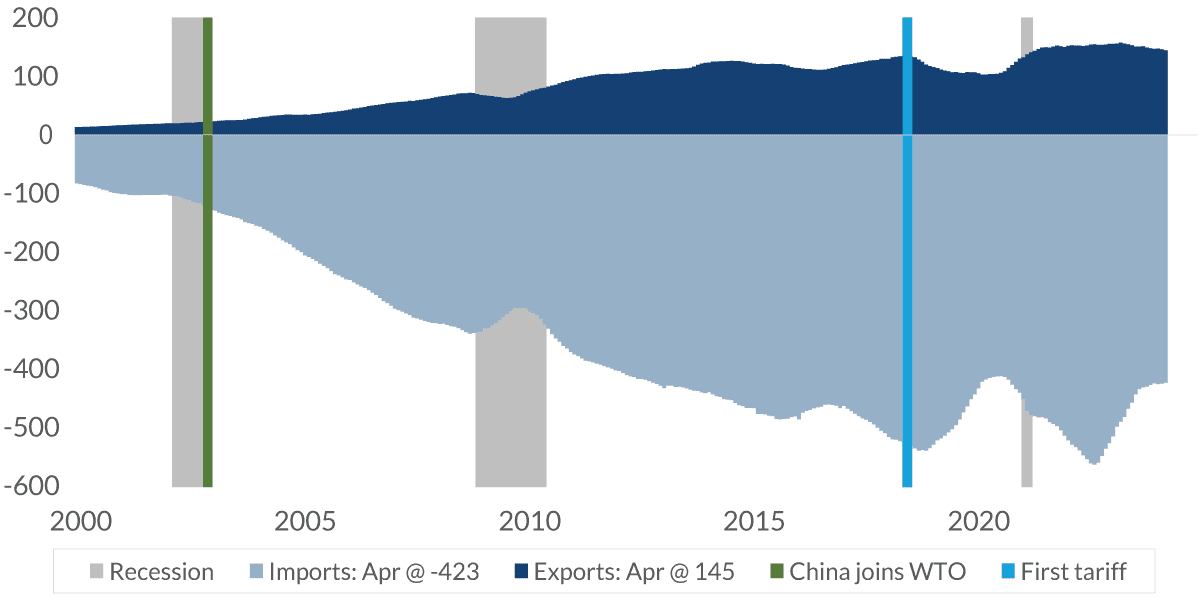

Chart 4: U.S. Trade Balance with China

$, billions, 12-month rolling total

Data current as of June 26, 2024

Sources: U.S. Census Bureau

Information is subject to change and is not a guarantee of future results.

Chart 4 4:33– The impact on China's trade with the United States has been dramatic. In the data going back to 2000, you can see that the exports to China in dark blue have grown from near zero to $145 billion in the past 12 months. This is a positive number because exports are positive in the GDP calculation.

But at the same time, imports from China, which is in the light blue, and represented as a negative number since they reduced GDP, have grown even faster. Imports from China are almost three times greater than exports, which concerns politicians.

Since the first of the recent tariffs were imposed in July of 2018, imports in China have been slightly reduced. The general attitude toward the benefits of cheap imports from China has changed. This is due to the large trade deficit’s impact on the U.S. economy.

As mentioned earlier, it was initially viewed as having many advantages, but that was in the 1990s with a robust economy. Things have changed since then.

Following the global financial crisis, when the unemployment rate was high and remained well above the neutral rate for a long time, economists noticed that the economic impact of cheap imports was significant on the U.S. economy.

What is now known as the "China Shock," it has revealed that the impact from the surge in Chinese exports on manufacturing employment in the United States was extremely significant. The implications of this shock are significant and far reaching.

This is devastating because many communities around the United States are centered around a manufacturing plant. For example, if a shoe factory closes and all the employees are laid off, this could be destructive to the economy of that community.

But overall, increased trade with China has brought both domestic winners and losers. However, the issue's political impact has remained strong, and it is believed to be behind the political polarization and backlash against free trade.

The "China Shock" and talk of "China Shock 2.0" are issues that are in the second installment of this video, to be released later this month.

Important Information

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. This presentation is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the securities mentioned herein.

Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results and are based primarily upon a hypothetical set of assumptions applied to certain historical financial information. Viewers are cautioned that such forward-looking statements are not a guarantee of future results, involve risks and uncertainties, and actual results may differ materially from those statements. Certain information has been provided by third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed.

Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as of the date of this video’s distribution and are subject to change.

Past performance or performance based upon assumptions is no guarantee of future results.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market.

City National Rochdale, LLC is an SEC-registered investment adviser and wholly-owned subsidiary of City National Bank. Registration as an investment adviser does not imply any level of skill or expertise. City National Bank is a subsidiary of the Royal Bank of Canada. City National Bank provides investment management services through its subadvisory relationship with City National Rochdale. Brokerage services are provided through City National Securities, Inc., a wholly-owned subsidiary of City National Bank and Member FINRA/SIPC.

Index Definitions

Chinese money is referred to by two names: the Chinese yuan (CNY) and renminbi (RMB), which translates to "People's Currency." The distinction between CNY and RMB is subtle. RMB is the official currency of China. The yuan is the principal unit of account for that currency.

The World Trade Organization (WTO) is the only global international organization dealing with the rules of trade between nations. At its heart are the WTO agreements, negotiated and signed by the bulk of the world’s trading nations and ratified in their parliaments. The goal is to help producers of goods and services, exporters, and importers conduct their business.

© 2024 City National Bank. All rights reserved.

CITY NATIONAL ROCHDALE, LLC NON-DEPOSIT INVESTMENT PRODUCTS ARE: • NOT FDIC INSURED •NOT BANK GUARANTEED •MAY LOSE VALUE

Stay Informed.

Get our Insights delivered straight to your inbox.

Put our insights to work for you.

If you have a client with more than $1 million in investable assets and want to find out about the benefits of our intelligently personalized portfolio management, speak with an investment consultant near you today.

If you’re a high-net-worth client who's interested in adding an experienced investment manager to your financial team, learn more about working with us here.