May 2024 Market Update

A Deep Dive into CNR’s Economic and Investment Outlook

May 30, 2024

May 30, 2024

U.S. Growth on Positive Trajectory

The economic outlook this month is optimistic with growth prospects continuing in positive territory in the U.S., along with improving global economic prospects, according to our leadership team at City National Rochdale. More than likely, the Federal Reserve’s rate hiking cycle is finished and policy headwinds for the market will moderate. Generally, the U.S. has a solid economic foundation, and the probability of a recession is low. We expect a moderate slowdown of GDP growth in 2024 and 2025.

Consumers continue to be resilient with job and wage growth supporting continued consumer spending. We anticipate improvements in corporate profits, inflation, credit conditions and the housing market. One key risk we continue to watch is geopolitical events.

Source: CNR Research, as of May 2024.

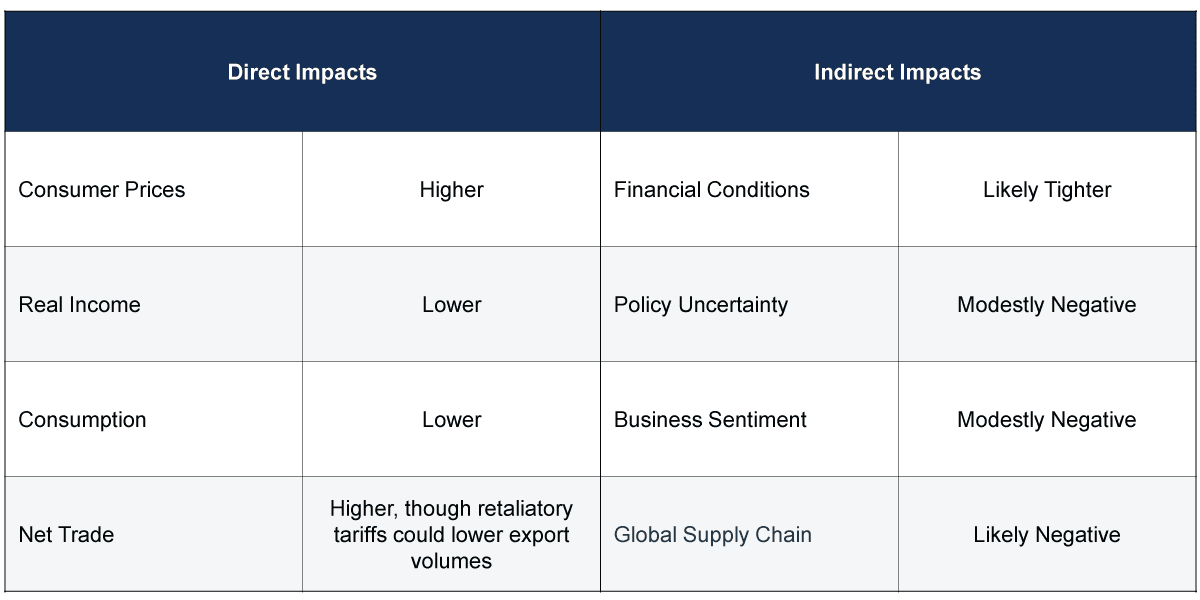

Elections around the globe are under scrutiny for their potential impact on the market. One particular area we’re monitoring as an outcome of the U.S. election in November is the possibility of new tariffs that could have both direct and indirect economic effects. If new tariffs are imposed, there’s a strong probability of higher consumer prices, lower consumption and lower real incomes. Higher net trade is a possibility, too, although retaliatory tariffs could lower export volumes. Overall, a new tariff environment could be trouble for continued U.S. economic growth. There would be additional pressure on business sentiment and global supply chains.

Source: Congressional Budget Office, as of May 2024. Information is subject to change and is not a guarantee of future results.

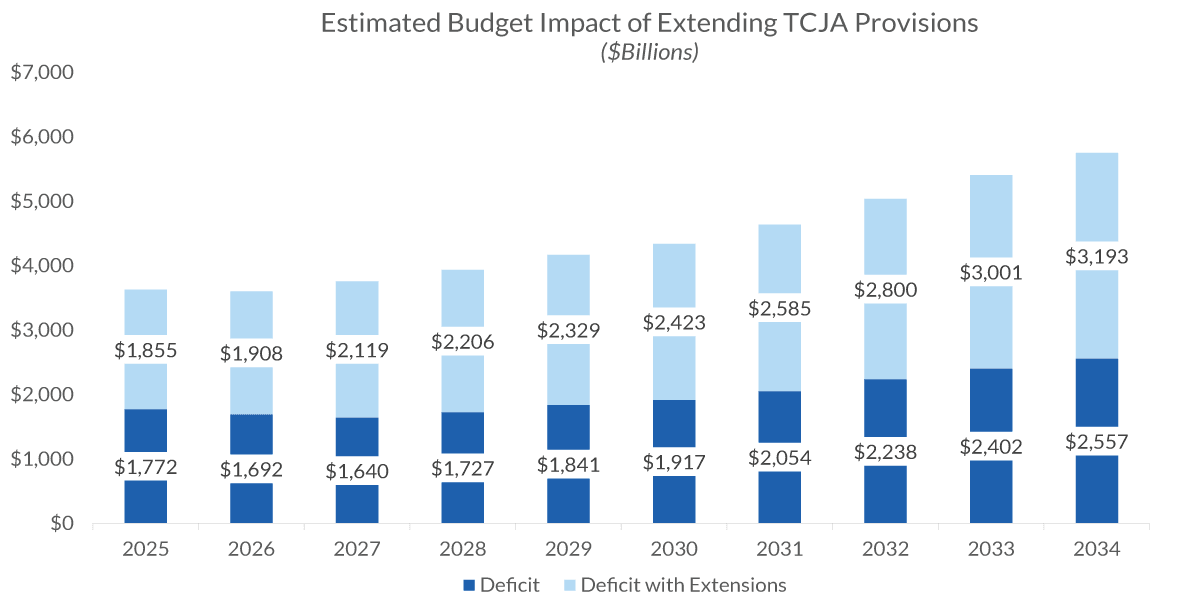

Election results in the U.S. will have major implications for the possible extension or expiration of the Tax and Jobs Act tax cuts that are scheduled to end in 2025. Beyond the impact on consumers, tax decisions will also impact the deficit. The U.S. deficit is already skyrocketing. If the tax credits are extended, this could create a significant increase in the deficit over time. Higher deficit growth would likely put upward pressure on interest rates.

While there are negative implications of higher interest rates, there could also be an opportunity to invest in municipal bonds for higher returns.

Source: Bloomberg, as of May 2024.

Information is subject to change and is not a guarantee of future results..

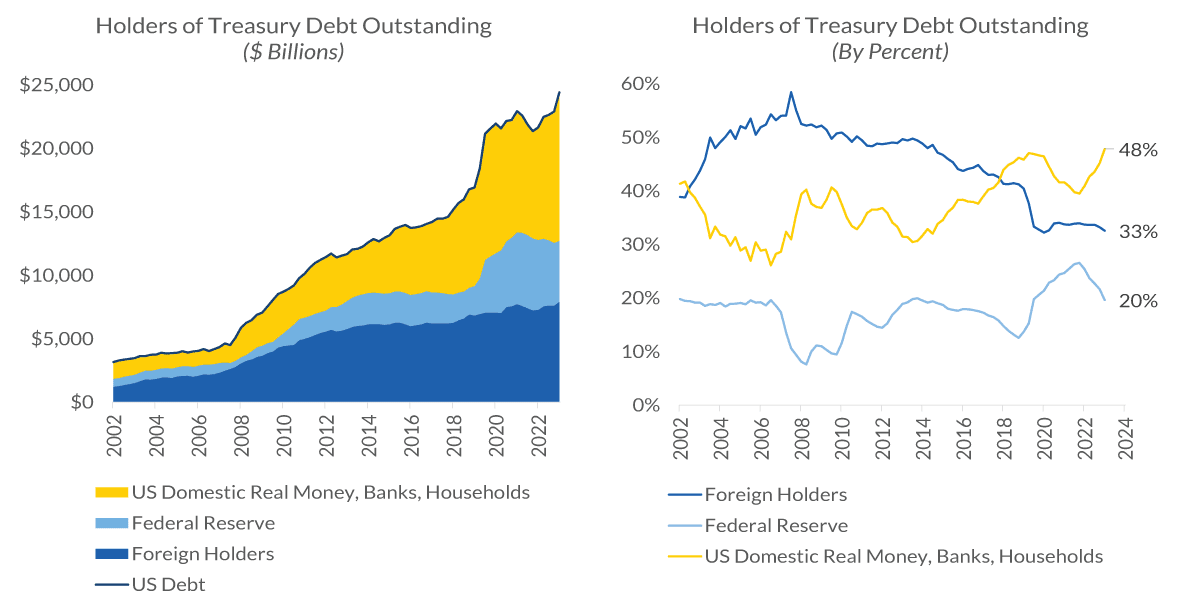

Election results are also likely to impact Treasuries, with a projected issuance of over $3 trillion by 2029. The share of foreign purchases of Treasuries has dropped significantly down to 33%, but domestic buyers have picked up the slack and represent 48% of buyers. However, domestic investors tend to be more price sensitive, which means rate volatility is likely here to stay.

Source: Bloomberg, as of May 2024.

Information is subject to change and is not a guarantee of future results

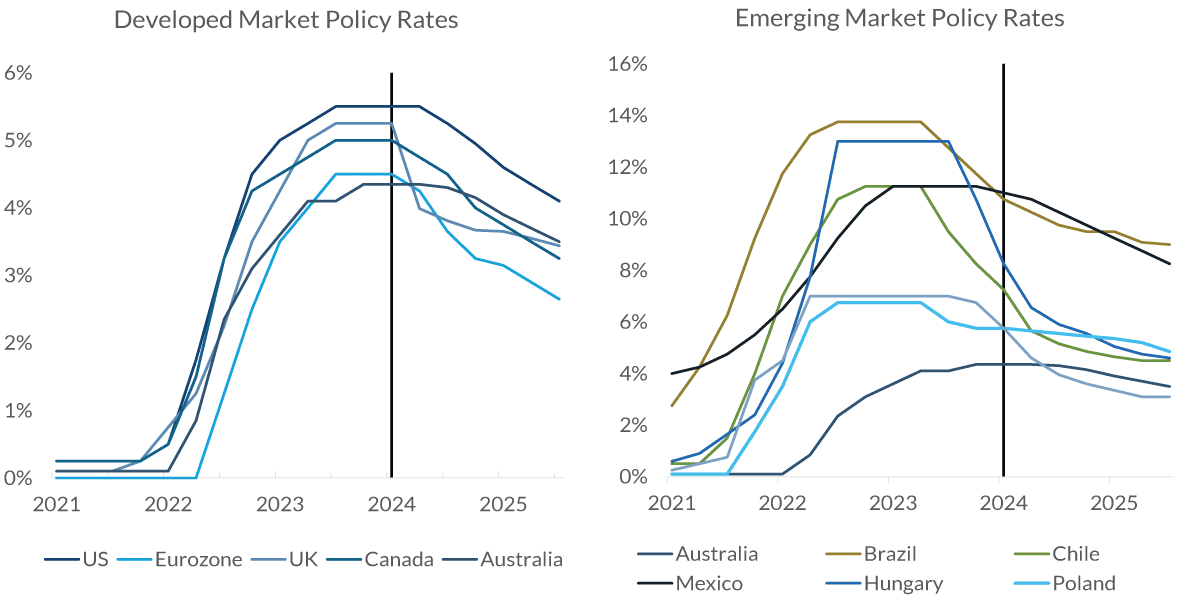

As part of our continuous monitoring of global markets, we anticipate that many global central banks are likely to ease their tightening policies before we see the first Fed rate cut in the U.S. Some central banks in emerging markets have already begun rate cuts. These cuts could stimulate the economies in those markets, which could increase returns on non-U.S. investments. However, we’re still waiting for more clarity around stable growth, currency stability and geopolitical issues before increasing our exposure to overseas investments.

Data current as of May 30, 2024

Source: Bureau of Economic Analysis

Information is subject to change and is not a guarantee of future results.

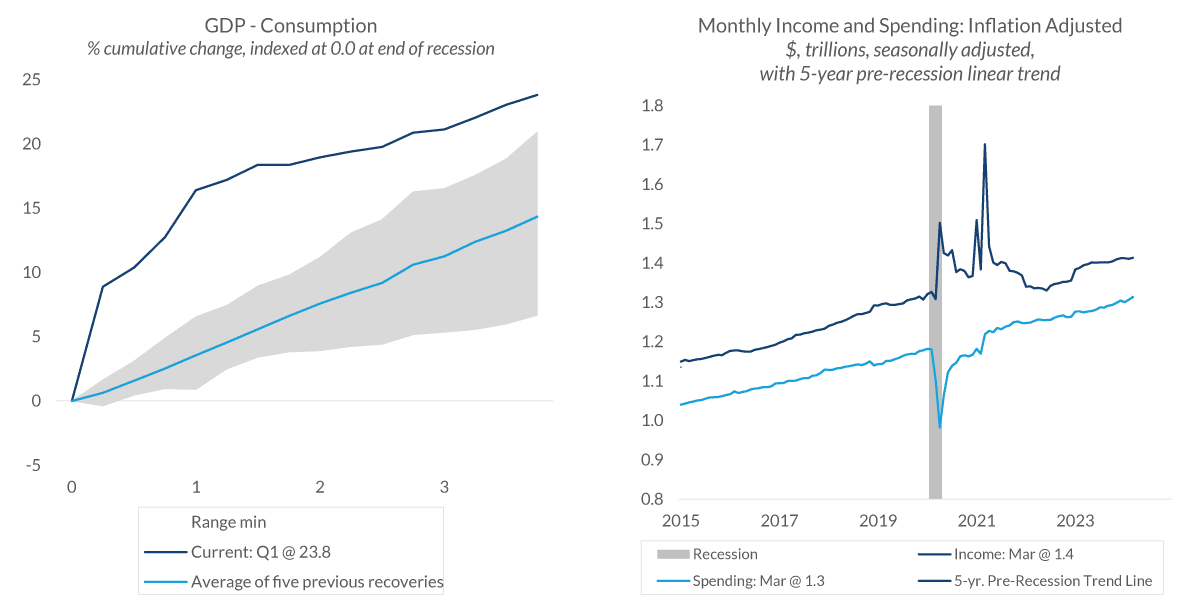

Consumer consumption continues to be the driving force of GDP in the U.S. and is up 23.8% since the end of the pandemic-related recession. Spending is anticipated to moderate because wage growth is slowing, hiring is slowing, and because household savings are being depleted. In addition, higher interest rates will take their toll. Overall, this will help balance the income and spending relationship to be in line with long-term trends.

Data current as of May 30, 2024

Source: Bureau of Labor Statistics

Information is subject to change and is not a guarantee of future results.

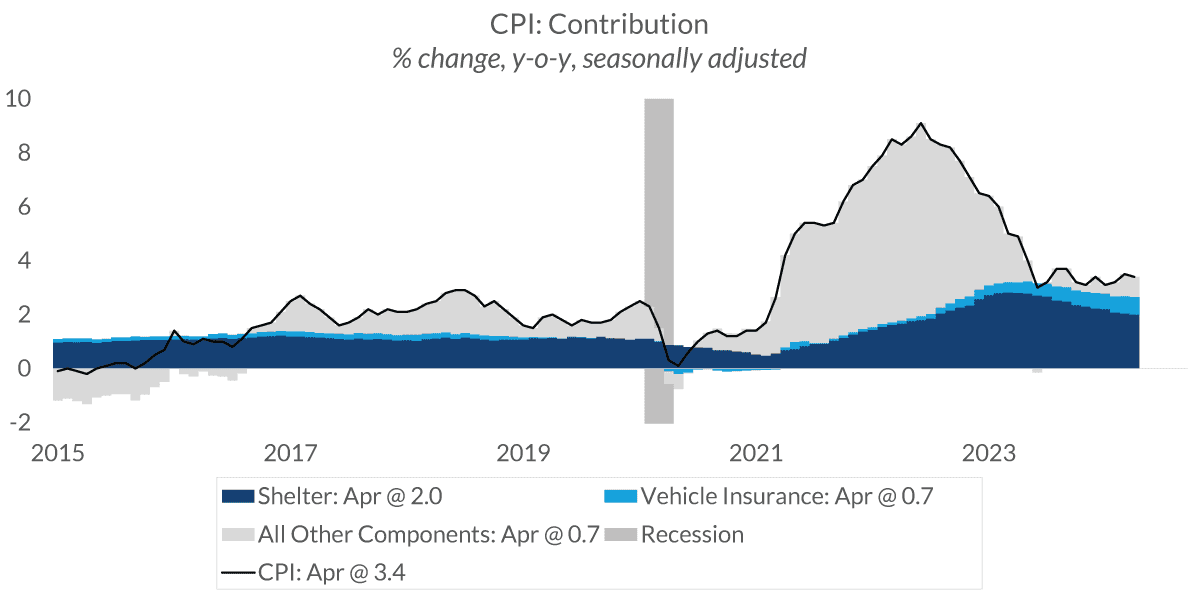

Inflation continues to moderate but is still too high for the Fed. The Consumer Price Index (CPI) is 3.4% year-over-year and the Fed’s target is 2.0%. Core CPI is 3.6%. The main drivers of inflation now are housing costs and auto insurance. Auto insurance rates have risen by 23% year-over-year, in part because of higher costs for labor and materials for repairs. In addition, claims dropped dramatically during the pandemic because fewer people were driving, followed by a period of higher claims once people returned to the roads.

Source: Bloomberg, Federal Reserve, CNR. As of May 2024.

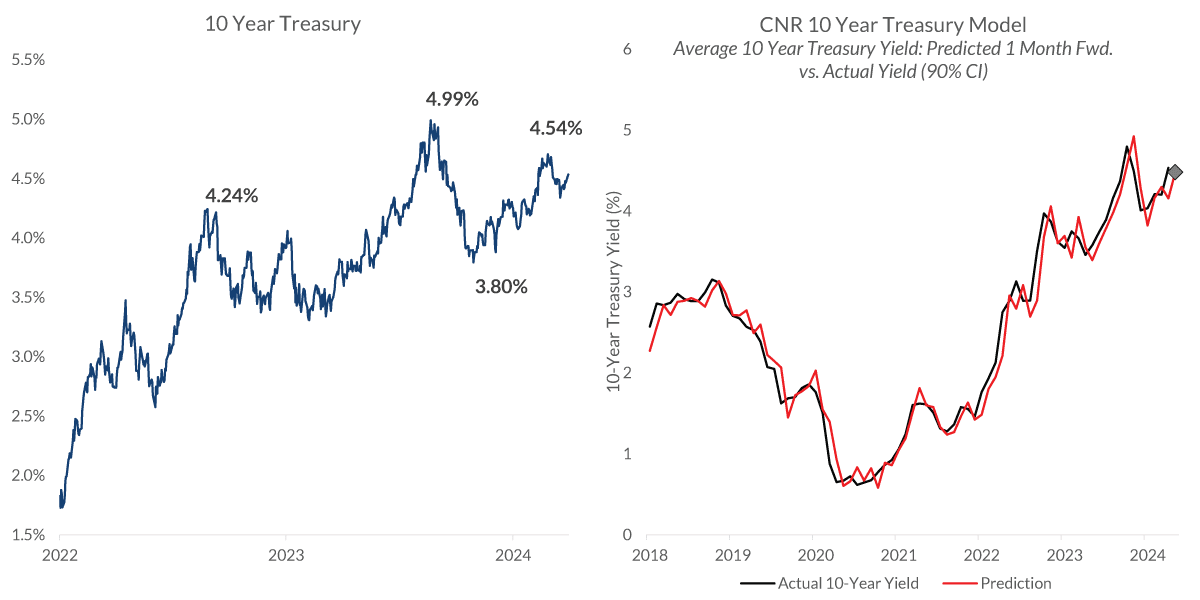

We model the average forward 10-year interest rate using an ARIMAX model of order (0,1,1) with exogenous variables term premium1 and inflation risk2. We train the ARIMAX model on a rolling window of 60 months and predict the average change in the 10-year interest rate over the next month. The data displayed in the figure shows the out-of-sample performance of the model.

Information is subject to change and is not a guarantee of future results.

Yields on the 10-Year Treasury have increased 4.1% year-to-date since the beginning of 2024. We believe our higher for longer thesis continues to play out, which should keep demand in check. Forward issuance and potential price fluctuations may challenge prices, but open entry points. Rates in the 4.1% to 4.6% range offer fair value. We anticipate the Fed to begin easing sometime in the second half of the year, so this is a good time to put money into Treasuries. The continued volatility may be challenging but can also offer opportunities.

Source: Bloomberg as of 4/30/2024, Bloomberg Intermediate Corporate Index, Investortools Perform.

Information is subject to change and is not a guarantee of future results.

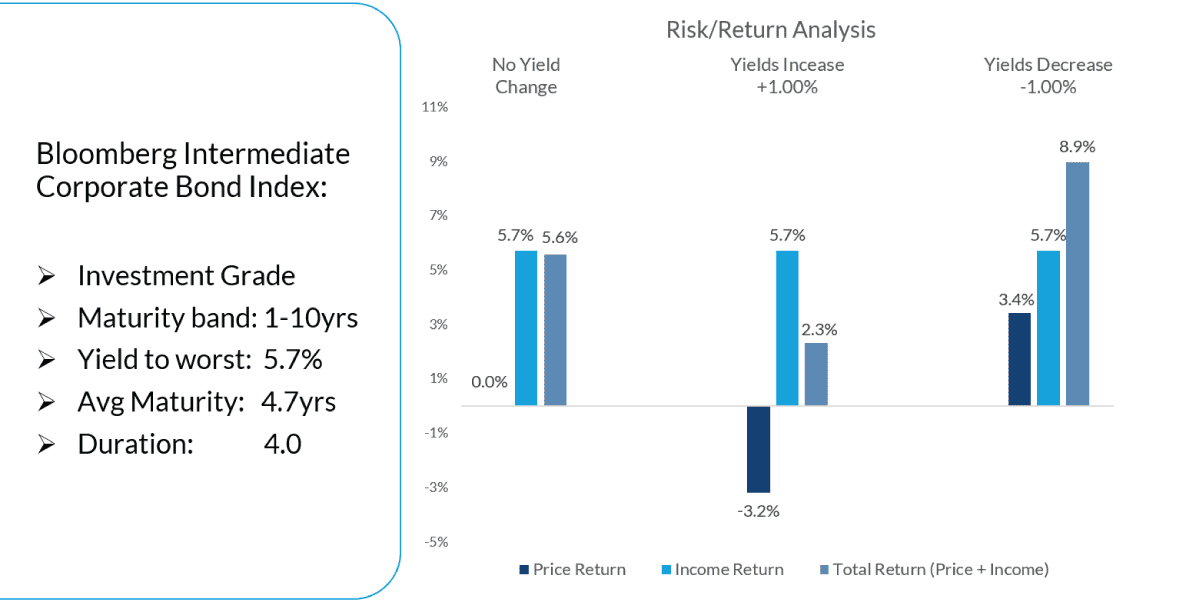

Higher income from corporate bonds is a great benefit for investors, but a secondary benefit is that the additional income provides a cushion for portfolios to offset market volatility. Scenario analysis supports the extension of duration on potential forward return outcomes. The higher for longer thesis and potential for future rate cuts provide a good risk-reward balance.

Source: FactSet, as of May 2024.

Information is subject to change and is not a guarantee of future results.

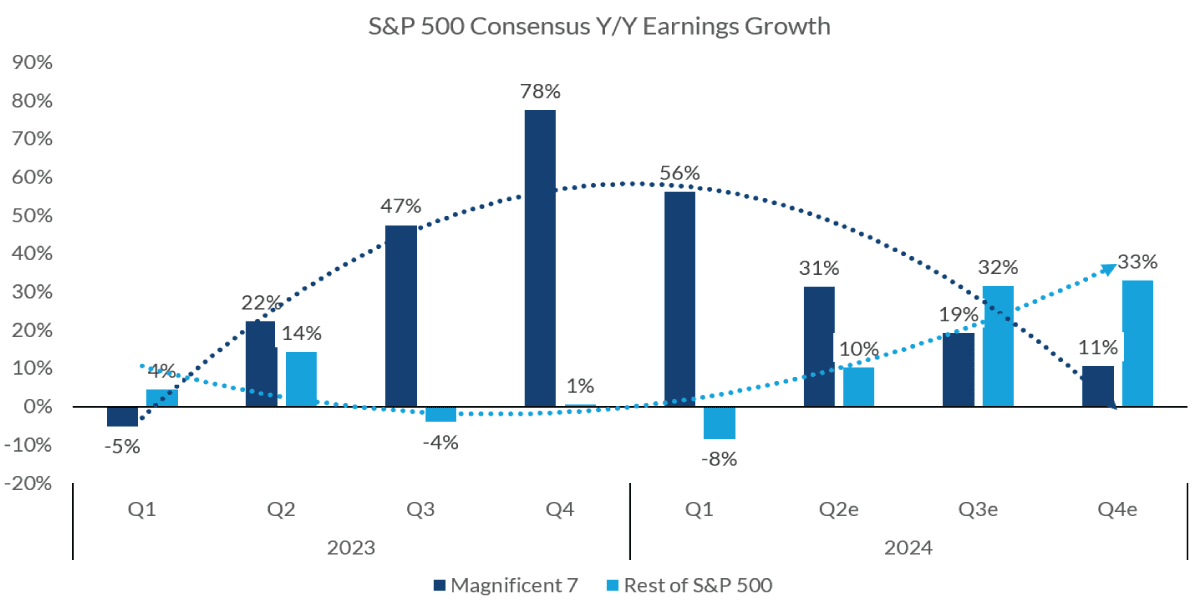

Much of 2023’s market gains were attributed to the “Magnificent Seven” tech stocks, but their market share peaked during the second quarter of 2024. During that quarter, tech stocks represented an estimated 31% of the market gains, while the rest of the market represented 10% of gains. That is expected to flip during the third quarter of 2024, when tech stock estimated earnings will likely be 19% of the market compared to 32% for other stocks. Estimates for the fourth quarter of 2024 show a similar trend, which bodes well for the CNR portfolio.

Source: FactSet, as of May 2024.

Information is subject to change and is not a guarantee of future results.

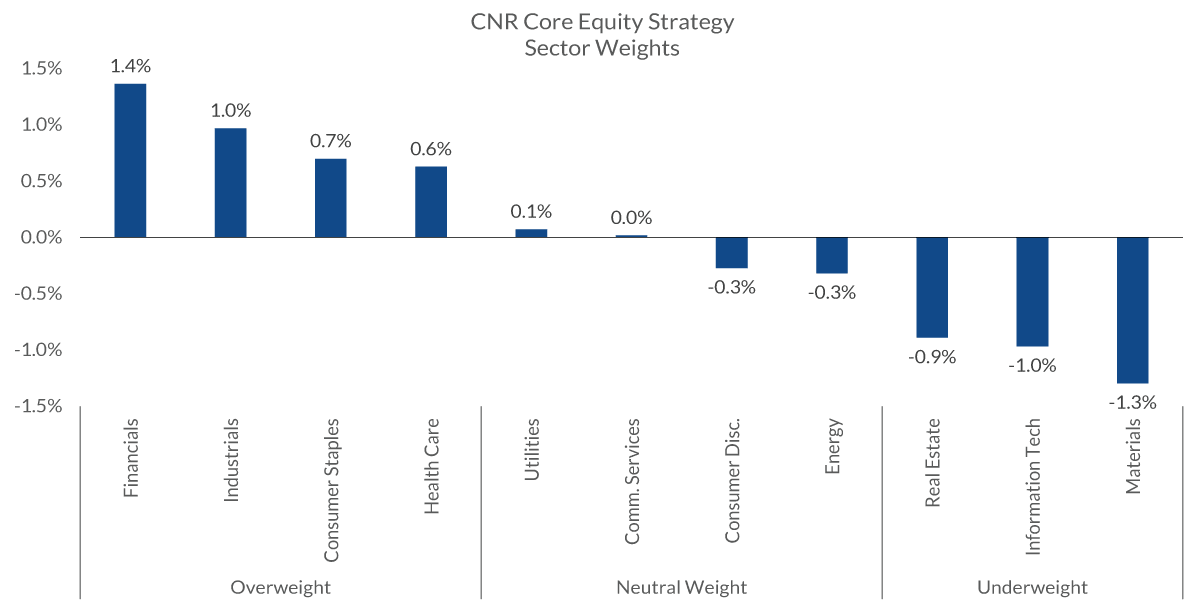

In addition to individual stock choices, we focus on sector positioning for long-term performance. We evaluate the quality, financial strength and competitive market position of various sectors. The investment team is currently overweight on industrial infrastructure and energy investments, along with the financial sector, which has more oversight and now includes the growing digital payments business that was formerly considered part of the tech sector. We are underweight on technology other than semiconductor manufacturing and AI. In addition, we avoid the commodities sector because of its volatility.

Review Your Portfolio with Your Financial Advisor Today

City National Rochdale encourages you to review your investment portfolio with your advisor. Contact our financial professionals today to get help with your wealth planning needs.

Index Definitions

The Standard & Poor’s 500 Index (S&P 500) is a market capitalization-weighted index of 500 common stocks chosen for market size, liquidity and industry group representation to represent U.S. equity performance.

A consumer price index (CPI) measures changes in the price level of a market basket of consumer goods and services purchased by households. The CPI is a statistical estimate constructed using the prices of a sample of representative items whose prices are collected periodically.

The Bloomberg Barclays US Intermediate Corporate Bond Index is a measure of the investment grade, fixed-rate, taxable corporate bond market. It includes USD-denominated securities publicly issued by US and non-US industrial, utility and financial issuers that have between 1 and up to, but not including, 10 years to maturity. The maturity range of the bonds included in the index is between 1 to 9.9999 years.

Definitions

Gross Domestic Product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period.

Yield to Worst (YTW) is the lower of the yield to maturity or the yield to call. It is essentially the lowest potential rate of return for a bond, excluding delinquency or default.

Important Information

The views expressed represent the opinions of City National Rochdale, LLC (CNR) which are subject to change and are not intended as a forecast or guarantee of future results. Stated information is provided for informational purposes only, and should not be perceived as personalized investment, financial, legal or tax advice or a recommendation for any security. It is derived from proprietary and non-proprietary sources which have not been independently verified for accuracy or completeness. While CNR believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and management's view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based-on assumptions which may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met, and investors may lose money. Diversification may not protect against market risk or loss. Past performance is no guarantee of future performance.

Indices are unmanaged, and one cannot invest directly in an index. Index returns do not reflect a deduction for fees or expenses.

CNR is free from any political affiliation and does not support any political party or group over another.

Bonds are subject to interest rate risks and will decline in value as interest rates rise.

HY: Investing in securities that are not investment grade offers a higher yield but also carries a greater degree of risk of default or downgrade and are more volatile than investment grade securities, due to the speculative nature of their investments.

Equity investing strategies & products. There are inherent risks with equity investing. These risks include, but are not limited to stock market, manager or investment style. Stock markets tend to move in cycles, with periods of rising prices and periods of falling prices.

Fixed Income investing strategies & products. There are inherent risks with fixed income investing. These risks include, but are not limited to, interest rate, call, credit, market, inflation, government policy, liquidity or junk bond risks. When interest rates rise, bond prices fall. This risk is heightened with investments in longer-duration fixed income securities and during periods when prevailing interest rates are low or negative.

High yield securities. Investments in below-investment-grade debt securities, which are usually called “high yield” or “junk bonds,” are typically in weaker financial health. Such securities can be harder to value and sell, and their prices can be more volatile than more highly rated securities. While these securities generally have higher rates of interest, they also involve greater risk of default than do securities of a higher-quality rating.

Municipal securities. The yields and market values of municipal securities may be more affected by changes in tax rates and policies than similar income-bearing taxable securities. Certain investors' incomes may be subject to the Federal Alternative Minimum Tax (AMT), and taxable gains are also possible. Investments in the municipal securities of a particular state or territory may be subject to the risk that changes in the economic conditions of that state or territory will negatively impact performance. These events may include severe financial difficulties and continued budget deficits, economic or political policy changes, tax base erosion, state constitutional limits on tax increases and changes in the credit ratings.

City National Rochdale, LLC is an SEC-registered investment adviser and wholly-owned subsidiary of City National Bank. Registration as an investment adviser does not imply any level of skill or expertise. City National Bank is a subsidiary of the Royal Bank of Canada. City National Bank provides investment management services through its subadvisory relationship with City National Rochdale. Brokerage services are provided through City National Securities, Inc., a wholly-owned subsidiary of City National Bank and Member FINRA/SIPC.

CITY NATIONAL ROCHDALE LLC NON-DEPOSIT INVESTMENT PRODUCTS: • ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY LOSE VALUE