-

Market Perspectives

2024 Takes a Turn

August 2024

- Filename

- Market Perspectives AUGUST 2024.pdf

- Format

- application/pdf

TRANSCRIPT

For much of 2024, it has been relatively quiet – that changed the past few weeks. We have been cautioning investors that volatility was likely to increase throughout the remainder of the year, and sure enough, volatility arrived and somewhat dramatically.

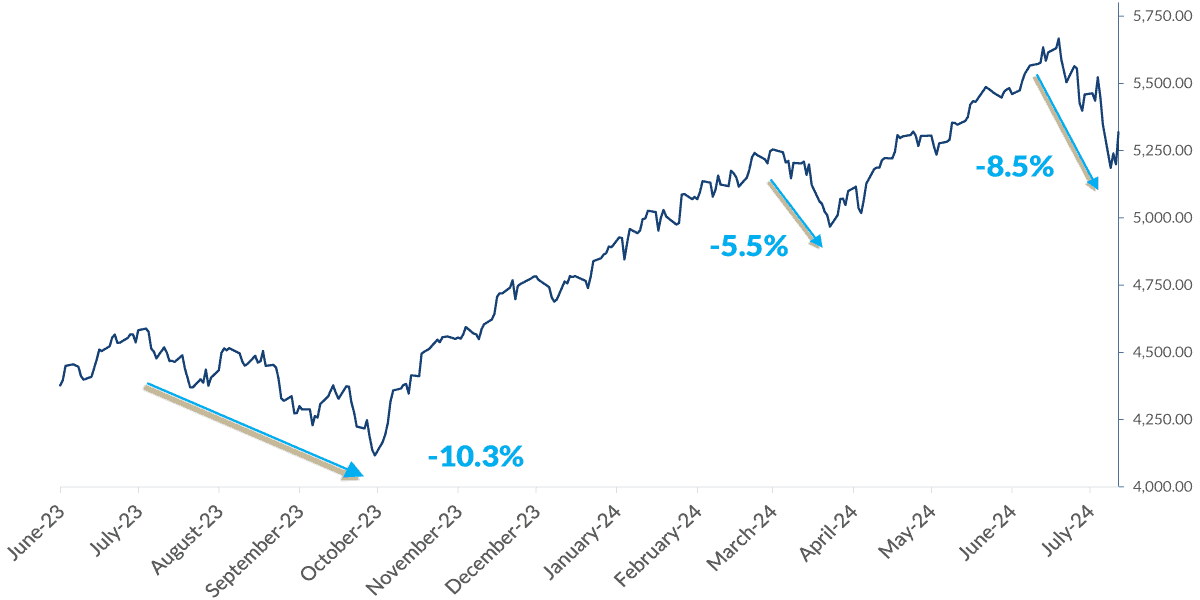

The recent volatility affected most major U.S. stock indices, but let’s focus on the broad market: the S&P 500. Except for an April pullback, the S&P 500 has spent much of 2024 achieving new record highs, the most recent being July 16, pushing the market into high valuation territory, especially the technology sector.

So, what changed and led to the recent pullback? Let’s review some important areas and provide some color:

First, U.S. economic growth concerns surfaced. The weaker-than-expected job increase numbers followed a deep contraction in the ISM report and a one-year high in jobless claims. More recent jobless claims numbers improved and eased some of these fears. We believe this is consistent with an expected slowdown, especially due to the increase in unemployment caused by an increase in the labor force.

The bottom line is the U.S. economy is slowing but still growing. Businesses are not hiring as many people, but they’re not firing many people either. The Fed is primed to lower interest rates at the September meeting and could provide a 50 basis point cut if deemed necessary.

Next, the corporate earnings outlook appears not as bright as it was. And while the majority of S&P 500 companies that have reported have posted a positive earnings per share, and positive revenue surprise, the magnitude of these surprises are below the average levels we’ve seen in the past five years. And despite the positive surprises and overall above expectation growth, earnings takeaways are leaning a bit more negative as talk about underwhelming revenue beat rates suggest concerns over a slowdown in consumer spending.

The third item: Election dynamics have changed. Harris replaced President Biden as the Democratic nominee, and momentum has shifted from Trump to Harris as swing state polls have narrowed and the betting odds of a Republican sweep have dropped from 51% to 34% – House controls now leaning Democratic. This development led some sector rotation as the so-called “Trump trade” unwound. But we have a long way to go until November, and the degree of uncertainty is likely to remain.

Next item, it was what was likely the most frequently asked question in early August is, “What the heck is the yen carry trade?” It’s simply a divergence in U.S. and Japanese monetary policy. The U.S. set to lower rates and the back Bank of Japan raised rates. This throws cold water on those investors borrowing in low interest rate Japanese currency to invest in higher yielding assets, for example, U.S. stocks.

And then finally, an escalation of tensions in the Middle East combined with the seemingly no-end-in-sight war in Ukraine further frayed investor nerves.

Now, all of these combined with a market that was trading at high valuations, which increased the probability of volatility as well as the magnitude. And again, it has been a relatively calm summer. It is easy to be lulled into complacency when the stock market is regularly reaching new highs. We can forget that volatility is common even during a rising market.

S&P 500

Sources: FactSet, as of August 8, 2024.

Information is subject to change and is not a guarantee of future results.

Chart 1, 3:52— In fact, this is the third 5% or more pullback in the past 12 months, including an outright 10% correction from August to late October last year.

It would be better for everyone’s nerves if the market simply moved up 20+% in a smooth, linear manner, but like many wedding reception dance floors, its rhythm is far more freeform.

Equity markets have stabilized for now, and the S&P 500 still stands in double digit territory as of filming. The most recent jobless claims number eased earlier employment fears. The yen carry trade appears to have run its course, and valuations, while still rich, are more reasonable. In addition, while the earnings growth outlook has softened, City National Rochdale still expects corporate profit growth to be between 9% and 12% in 2024 and 8% and 12% next year.

Important upcoming economic data on inflation, retail sales, and housing will be watched closely. We advise that you stay prepared for additional bouts of volatility through the remainder of 2024. We do not recommend reducing portfolio equity allocations, and we maintain our focus on high quality, reasonably valued U.S. companies with durable franchises and strong management.

Important Information

The views expressed represent the opinions of City National Rochdale, LLC (CNR) which are subject to change and are not intended as a forecast or guarantee of future results. Stated information is provided for informational purposes only, and should not be perceived as personalized investment, financial, legal or tax advice or a recommendation for any security. It is derived from proprietary and non-proprietary sources which have not been independently verified for accuracy or completeness.

While CNR believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and management's view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions which may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements.

Past performance or performance based upon assumptions is no guarantee of future results.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market.

Equity investing strategies & products. There are inherent risks with equity investing. These risks include, but are not limited to stock market, manager or investment style. Stock markets tend to move in cycles, with periods of rising prices and periods of falling prices.

Fixed Income investing strategies & products. There are inherent risks with fixed income investing. These risks include, but are not limited to, interest rate, call, credit, market, inflation, government policy, liquidity or junk bond risks. When interest rates rise, bond prices fall. This risk is heightened with investments in longer-duration fixed income securities and during periods when prevailing interest rates are low or negative.

Municipal securities. The yields and market values of municipal securities may be more affected by changes in tax rates and policies than similar income-bearing taxable securities. Certain investors' incomes may be subject to the Federal Alternative Minimum Tax (AMT), and taxable gains are also possible. Investments in the municipal securities of a particular state or territory may be subject to the risk that changes in the economic conditions of that state or territory will negatively impact performance. These events may include severe financial difficulties and continued budget deficits, economic or political policy changes, tax base erosion, state constitutional limits on tax increases and changes in the credit ratings.

City National Rochdale, LLC is an SEC-registered investment adviser and wholly-owned subsidiary of City National Bank. Registration as an investment adviser does not imply any level of skill or expertise. City National Bank is a subsidiary of the Royal Bank of Canada. City National Bank provides investment management services through its subadvisory relationship with City National Rochdale. Brokerage services are provided through City National Securities, Inc., a wholly-owned subsidiary of City National Bank and Member FINRA/SIPC.

© 2024 City National Rochdale, LLC. All rights reserved.

Index Definitions

The Standard & Poor’s 500 Index is a market capitalization-weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent US equity performance.

Stay Informed.

Get our Insights delivered straight to your inbox.

Check out previous perspectives:

Put our insights to work for you.

If you have a client with more than $1 million in investable assets and want to find out about the benefits of our intelligently personalized portfolio management, speak with an investment consultant near you today.

If you’re a high-net-worth client who's interested in adding an experienced investment manager to your financial team, learn more about working with us here.