CNR Speedometers®

March 2024

Forward-Looking Six to Nine Months

TRANSCRIPT

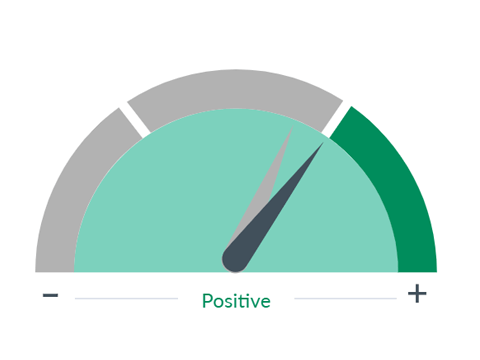

The key takeaway is: Our confidence continues to increase after a period of slowing economic activity in the first half of the year, the stage is being set for an improved outlook in the second half of the year that should continue into 2025. As a result, several of our dials have shifted modestly to the right, and that has taken four of those dials into the green zone.

■ Previous Month ■ Current Month

Labor Market

What we see

Research has shown that employment and income expectations, along with credit availability, are the most important determinants of consumer spending. Personal consumption amounts to roughly 70% of GDP, making a strong labor market essential to a healthy economy.

Dial 1: Labor Market 0:37— The labor market dial shifted modestly and into the green zone. Recent readings have been strong, and revisions have been to the upside. Unemployment claims have been low, and stable for some time now, and while the news headlines highlight company-specific layoffs, the broad-based Challenger layoff survey has been surprisingly benign.

While normalization in the labor markets will continue as the year unfolds, supply and demand imbalances remain, as evidenced by the recent JOLTS data. As a result, the outlook for wage gains remains healthy. These wage gains, combined with continued positive impacts from the wealth effect, will also have positive impacts on two other consumer dials.

■ Previous Month ■ Current Month

Consumer Spending

What we see

Aggregate level of consumer spending. Since consumers are the largest driver of the U.S. economy, their spending patterns have a large impact on overall economic activity.

Dial 2: Consumer Spending 1:23— Consumer spending also shifted modestly into the green zone. We continue to believe consumer spending will moderate in the coming months after the healthy pace of spending since last fall, but we do not see a contraction coming. Looking out six to nine months, this slowdown should set the stage for a pickup in the second half of the year.

In addition to the benefits from the labor market and the wealth effect, growth in income and wages as we've seen in the recent data remains above headline inflation, and barring some unexpected surge in energy prices, the positive spread between income inflation should lead to higher consumer spending in the back half of the year. Consumer sentiment should also continue to benefit from these factors as well.

■ Previous Month ■ Current Month

Consumer Sentiment

What we see

How consumers feel about their overall financial health as well as that of the economy on the short and long term. This is an important indicator, as the consumer is the largest driver of the U.S. economy.

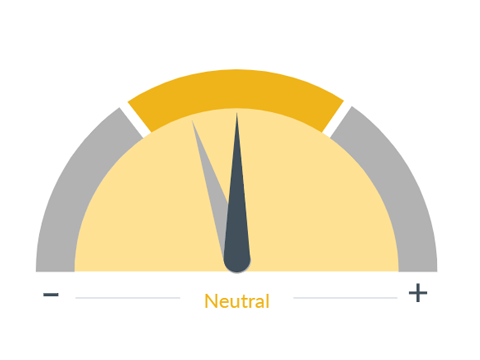

Dial 3: Consumer Sentiment 2:08— While recent measures of consumer sentiment declined after several months of increases, a pullback was overdue, and we do not view it as a seed change. Indeed, when looking at rolling six-month data of consumer sentiment, the trend is clearly up.

Additionally, for the first time in a while, the downward shift in future expectations, which is much lower than the downward shift in current conditions, indicates consumers may be feeling better about the longer term, which is a good thing.

■ Previous Month ■ Current Month

Inflation

What we see

While a slow, persistent rise in prices is consistent with a healthy, growing economy, a rapid increase in inflation, especially if unanticipated, can be harmful. Inflation means higher consumer prices, which often slows sales and reduces profits.

Dial 4: Inflation 2:39— Inflation also shifted modestly into the green zone. While the month-over-month number was modestly higher than expected, the year-over-year growth rates continue to tick down. While still higher than the Fed wants to see, and the battle against inflation isn't over, we're having increased confidence in our downward glide path expectations.

■ Previous Month ■ Current Month

Business Outlook Spending/Surveys

What we see

Surveys of the business community on current and expected trends. This is a gauge on businesses' spending plans that provides an insight into wages, inflation, and capital equipment spending.

Dial 5: Business Outlook 3:00— Finally, the business outlook shifted more positively. While manufacturing continues to be sluggish, we see signs of encouragement from increases in CEO confidence and improvements in business activity, as evidenced in the recent ISM survey data.

In conclusion, our confidence continues to increase that after a period of solely economic activity in the first half of the year, the stage will be set for an improved economic activity in the back half of the year. That should continue into 2025.