-

Fixed Income Perspectives

Midyear Check-up

July 2024

- Filename

- Fixed Income Perspectives JULY 2024.pdf

- Format

- application/pdf

TRANSCRIPT

With the first half of the year behind us, let's start with the scorecard:

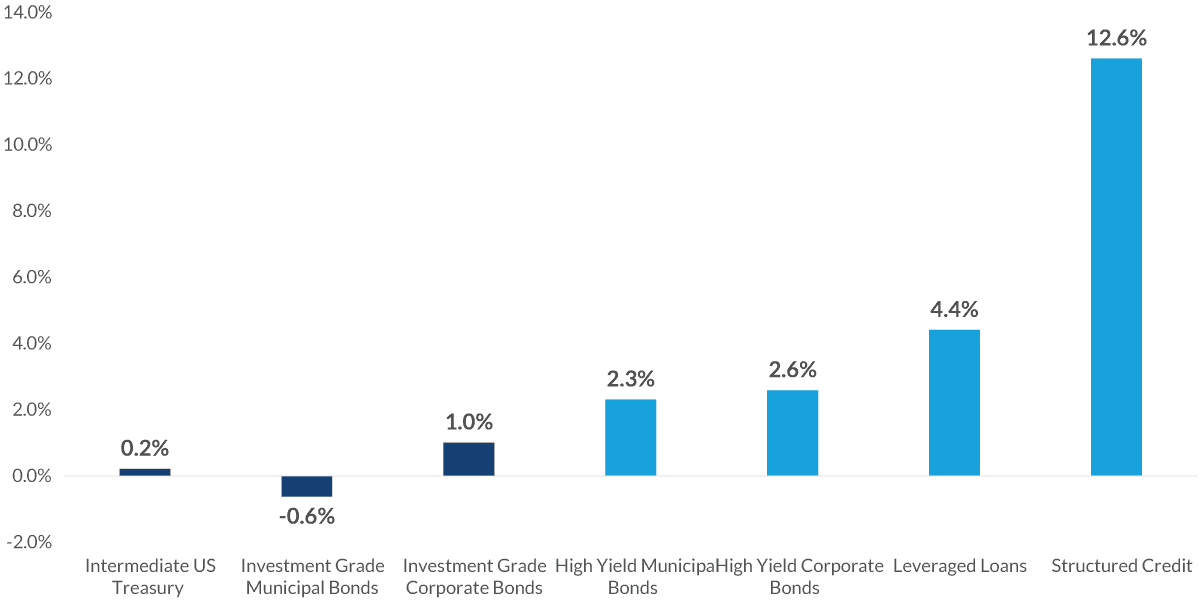

Total Return Across Fixed Income Asset Classes

YTD - June 30, 2024

Municipal bond index yields are tax-adjusted at 37% federal and 3.8% Medicare surcharge rates.

Sources: Bloomberg, CNR Research, as of May 2024. Information is not representative of any CNR product or service. Indices are unmanaged, and one cannot invest directly in an index. Index returns do not reflect a deduction for fees or expenses. Information is subject to change and is not a guarantee of future results.

Index information: Intermediate US Treasury: Bloomberg U.S. Treasury: Intermediate Index. Investment Grade Municipal Bonds: Bloomberg U.S. 1-15 Yr. Municipal Bond Index. Investment Grade Corporate Bonds: Bloomberg U.S. Intermediate Corporate Bond Index. High Yield Municipal Bonds: Bloomberg 60% Tax-Exempt HY/40% LB Municipal Bond Index. High Yield Corporate Bonds: Bloomberg U.S. High Yield Corporate Bond Index. Leveraged Loans: Morningstar LSTA U.S. Leveraged Loan Index. Structured Credit: Palmer Square CLO BB Index.

Chart 1, 0:18– During the first quarter, returns across the fixed income markets were pressured as core inflation accelerated and job growth surprised to the upside. However, yields have dropped and remained below 2024 highs as inflation data has eased and economic growth has started to cool.

Still, treasury yields remain a bit higher than last year, with intermediate treasuries and corporates showing positive year-to-date returns, while municipals are slightly in the red, giving back some of the strong performance from the end of 2023. The clear winners so far this year have been in the high yield sectors, where credit quality has remained resilient as issuers have been able to successfully navigate the higher rate environment and high absolute yields have drawn investor demand.

As we look to the second half of the year, our focus now turns to the Fed. As expected, at the June meeting, officials left rates unchanged for the seventh consecutive meeting. While acknowledging progress toward the stated 2% inflation objective, the Fed continues to remain concerned about inflation. But more importantly, it reduced the number of expected rate cuts from three to one for the remainder of the year.

In addition, Fed officials once again revised their estimate of the longer-run Fed Funds target rate from 2.6% in March to 2.8% in June. We view this as a significant adjustment and believe it reflects structurally higher interest rates over time. From a macro standpoint, we continue to expect moderation across a number of economic measures that will lead to slower economic growth driven by cooling labor, a more budget-conscious consumer, and easing inflationary pressures.

The latest jobs report clearly showed cooling as prior months numbers were revised down. This, combined with an uptick in the unemployment rate from 4% to 4.1% and moderation in average hourly earnings, shows that policy is restrictive, helping make the argument for rate cuts to begin.

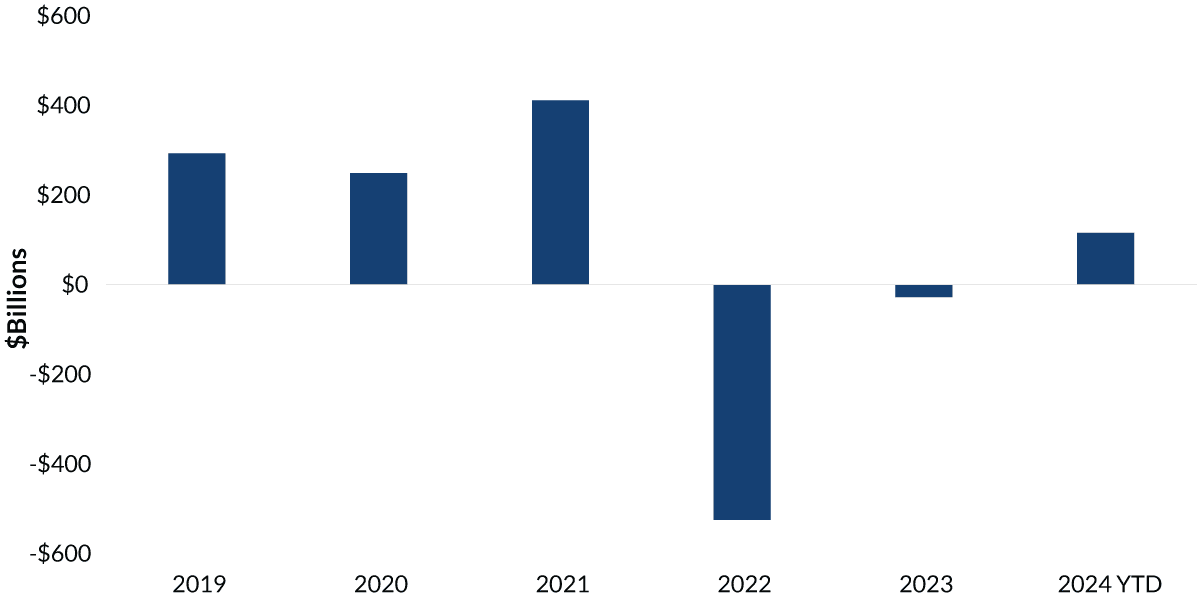

ICI Total Bond Estimated Weekly Net New Cash Flow

Source:Bloomberg as of 6/14/2024

Information is subject to change and is not a guarantee of future results

ICI – Investment Company Institute

Chart 2, 2:16– Despite treasury yields being higher on the year and uncertainty surrounding the timing of Fed rate cuts, one might expect that investors would be cautious about adding to their bond investments.

However, as you can see in this chart, flows into fixed income mutual funds have turned positive for the first time since 2021, with about $114 billion coming into the market. Higher yields are attracting capital, and investors are growing more comfortable with elevated rate volatility. The risk reward in fixed income has improved substantially.

Bringing this all together, we believe the data will support the Fed being able to cut rates later this year, with the first rate cut coming as soon as September, and as we approach a turning point in Fed policy, history shows that investors may benefit over the long run by pivoting away from cash and extending the average maturity of their fixed income portfolios.

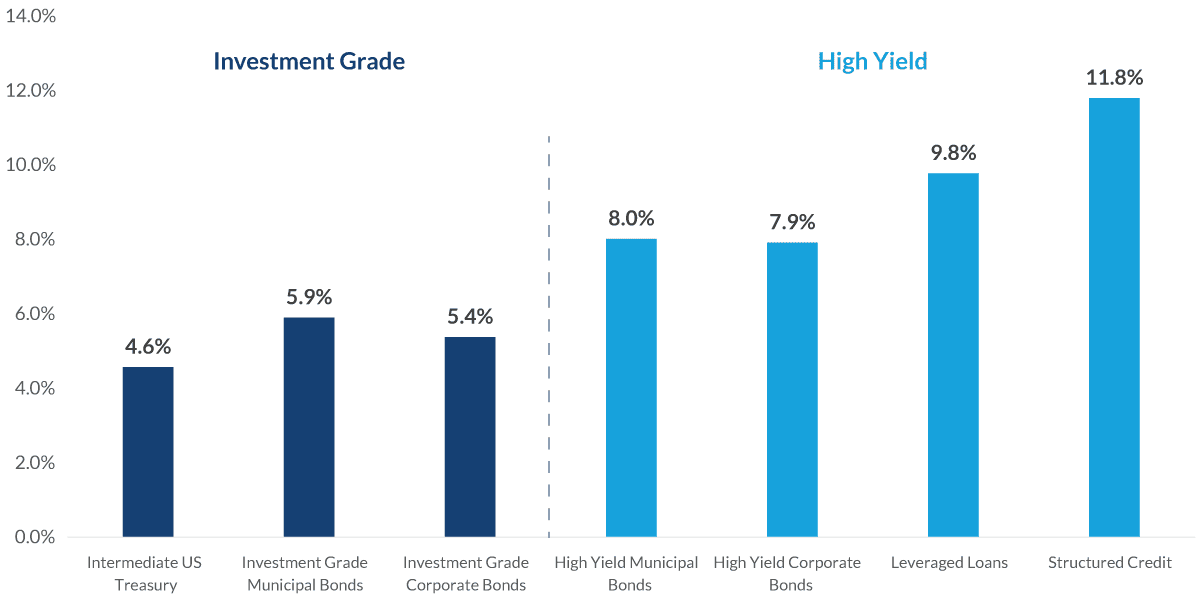

Yield Levels Across Fixed Income Asset Classes

Municipal bond index yields are tax-adjusted at 37% federal and 3.8% Medicare surcharge rates.

Sources: Bloomberg, CNR Research, as of May 2024. Information is not representative of any CNR product or service.

Indices are unmanaged, and one cannot invest directly in an index. Index returns do not reflect a deduction for fees or expenses. Information is subject to change and is not a guarantee of future results.

Index information: Intermediate US Treasury: Bloomberg U.S. Treasury: Intermediate Index. Investment Grade Municipal Bonds: Bloomberg U.S. 1-15 Yr. Municipal Bond Index. Investment Grade Corporate Bonds: Bloomberg U.S. Intermediate Corporate Bond Index. High Yield Municipal Bonds: Bloomberg 60% Tax-Exempt HY/40% LB Municipal Bond Index. High Yield Corporate Bonds: Bloomberg U.S. High Yield Corporate Bond Index. Leveraged Loans: Morningstar LSTA U.S. Leveraged Loan Index. Structured Credit: Palmer Square CLO BB Index.

Chart 3, 3:07– With our expectation for credit quality remaining resilient and high levels of income to provide a cushion for market volatility, yields remain attractive with investment grade corporates north of 5%, tax-adjusted municipals close to 6% — again, reflecting the benefit municipals have for investors in high tax brackets — and the high yield markets yielding close to 8%.

Important Information

The views expressed represent the opinions of City National Rochdale, LLC (CNR) which are subject to change and are not intended as a forecast or guarantee of future results. Stated information is provided for informational purposes only, and should not be perceived as personalized investment, financial, legal or tax advice or a recommendation for any security. It is derived from proprietary and non-proprietary sources which have not been independently verified for accuracy or completeness. While CNR believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Actual results, performance or events may differ materially from those expressed or implied in such statements. All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met, and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance.

City National Rochdale, LLC is an SEC-registered investment adviser and wholly-owned subsidiary of City National Bank. Registration as an investment adviser does not imply any level of skill or expertise. City National Bank is a subsidiary of the Royal Bank of Canada. City National Bank provides investment management services through its subadvisory relationship with City National Rochdale. Brokerage services are provided through City National Securities, Inc., a wholly-owned subsidiary of City National Bank and Member FINRA/SIPC.

Fixed Income investing strategies & products. There are inherent risks with fixed income investing. These risks include, but are not limited to, interest rate, call, credit, market, inflation, government policy, liquidity or junk bond risks. When interest rates rise, bond prices fall. This risk is heightened with investments in longer-duration fixed income securities and during periods when prevailing interest rates are low or negative.

Index Definitions:

The Bloomberg Barclays US Intermediate Corporate Bond Index is a measure of the investment grade, fixed-rate, taxable corporate bond market. It includes USD-denominated securities publicly issued by US and non-US industrial, utility and financial issuers that have between 1 and up to, but not including, 10 years to maturity. The maturity range of the bonds included in the index is between 1 to 9.9999 years.

Bloomberg U.S. 1-15 Yr. Municipal Bond Index consists of a broad selection of investment grade general obligation and revenue bonds of maturities ranging from one year to 17 years.

Bloomberg Tax-Exempt HY is market value-weighted and designed to measure the performance of U.S. dollar-denominated high-yield municipal bonds issued by U.S. states, the District of Columbia, U.S. territories and local governments or agencies.

Bloomberg U.S. 6M Treasury Bill Index: The 6 Month Treasury Bill Rate is the yield received for investing in a US government issued treasury bill that has a maturity of 6 months.

The Bloomberg Barclays U.S. Corporate High Yield Index is an unmanaged, U.S.-dollar-denominated, nonconvertible, non-investment-grade debt index. The index consists of domestic and corporate bonds rated Ba and below with a minimum outstanding amount of $150 million.

Morningstar LSTA U.S. Leveraged Loan Index is designed to measure the performance of the 100 largest facilities in the US leveraged loan market.

Palmer Square CLO BB Index is a rules-based observable pricing and total return index for CLO debt sold in the United States, rated A, BBB or BB (or equivalent rating), i.e., mezzanine CLO debt.

© 2024 City National Rochdale, LLC. All rights reserved.

Stay Informed.

Get our Insights delivered straight to your inbox.

Check out previous perspectives:

Put our insights to work for you.

If you have a client with more than $1 million in investable assets and want to find out about the benefits of our intelligently personalized portfolio management, speak with an investment consultant near you today.

If you’re a high-net-worth client who's interested in adding an experienced investment manager to your financial team, learn more about working with us here.