-

Economic Perspectives

The Fed

September 2024

- Filename

- Economic Perspectives SEPTEMBER 2024.pdf

- Format

- application/pdf

TRANSCRIPT

The Fed kicked off an easing cycle by slashing the federal funds rate by 50 basis points in a decisive move to help keep the employment growth strong. Throughout most of the summer, Fed watchers highly expected the Fed to cut interest rates at the mid-September meeting but debated about the size. Would it be 25 basis points, or would it be 50 basis points?

Well, the Fed decided to go big. It opted for a more assertive approach due to the cooling of labor growth and the high level of confidence that it has that inflation is headed toward their target of 2%.

Let’s take a look at some charts.

Chart 1: Federal Funds Rate

%, median rate

Data current as of September 23, 2024

Source: Federal Reserve Bank

Information is subject to change and is not a guarantee of future results.

Chart 1, 0:52– The first chart is a column chart showing the federal funds rate since January 2022. That was just before the Fed began increasing interest rates, which started in March. Once the Fed began increasing rates, it did so at a very brisk pace. It increased the funds rate by 525 basis points, one of the most aggressive increases in the past 50 years. In addition, it kept the funds rate at the peak level for 14 months, the second-longest term in more than 50 years.

Then it made its first cut of 50 basis points and stated that it planned on another 50 basis points in cuts this year. As for the remainder of the year, there is no FOMC meeting in October. So, the expectation is that there’ll be a 25 basis point cut at its November meeting, which was delayed a few days to be after the presidential election, and then another 25 basis points cut at its mid-December meeting. It is planning on 100 basis points in cuts next year. The timing of those cuts is not known. Just at the end of the year, the federal funds rate will be 100 basis points lower. The timing of those cuts will depend on the incoming economic data, especially labor data.

Now each quarter, the Fed provides forecasts for the unemployment rate, inflation, GDP, and the federal funds rate. I’ll review those forecasts with you, starting with the unemployment rate.

The columns on the right side of the chart are the Fed’s expectations for the unemployment rate in the years to come. On the left side of the page is the recent history.

Chart 2: FOMC Projections - Unemployment Rate

%, historical data is seasonally adjusted

Data current as of September 23, 2024

Sources: The Federal Reserve Bank, Bureau of Labor Statistics

Information is subject to change and is not a guarantee of future results.

Chart 2, 2:31– The first column is December 2024, just before the start of 2025, which is the number you see below. With the current rate at 4.2%, the Fed is not expecting much change in the unemployment rate over the next few years. Yes, the unemployment rate is up from a low of 3.4% in January 2023, but that was an unsustainably low level.

This is a more sustainable level. An unemployment rate in the range of 4% to 4.5% is considered full employment, and the following chart shows this history.

Chart 3: Unemployment Rate

%, seasonally adjusted

Data current as of September 23, 2024

Source: Bureau of Labor Statistics

Information is subject to change and is not a guarantee of future results.

Chart 3, 3:08– Since 1950, there have only been two other times when the unemployment rate was below 4% for a sustained period of time, and that was in the early 1950s and the late 1960s.

Both times, the country was at war, either in Korea or Vietnam, and back then, there was a draft. So many young men were not in the pool of available workers, driving down the unemployment rate. This time, there is no draft, just a robust economy. But there is some growing concerns. They’re not worries, but they are concerns.

Chart 4: Nonfarm Payrolls

'000, seasonally adjusted

Data current as of September 23, 2024

Source: Bureau of Labor Statistics

Information is subject to change and is not a guarantee of future results.

Chart 4, 3:43– The new pace of hiring is slowing. The columns in this chart show the monthly changes in nonfarm payrolls. Since this series can be volatile, we look at it on a three-month moving average, the dark blue line, which is currently at 116,000. That’s about 100,000 lower than it was a year ago. More importantly, it’s just above the 100,000 threshold, which is generally viewed as the population that’s coming into the workforce.

This is probably at the low end of what the Fed wants to see and is probably the reason why the Fed was so aggressive in the first interest rate cut. It wants to jump-start the demand for workers to ensure that the growth of the labor market reaccelerates.

Chart 5: FOMC Projections - Inflation (Core-PCE)

%, seasonally adjusted annual rate

Data current as of September 23, 2024

Sources: The Federal Reserve Bank, Bureau of Economic Analysis

Information is subject to change and is not a guarantee of future results.

Chart 5, 4:27– Here’s the Fed’s outlook for inflation. After peaking in February 2022, the Fed is confident that the high level of federal funds rate helped bring down inflation and is now on a trajectory toward a sustainable 2%, which is its target level. Recent data supports that belief.

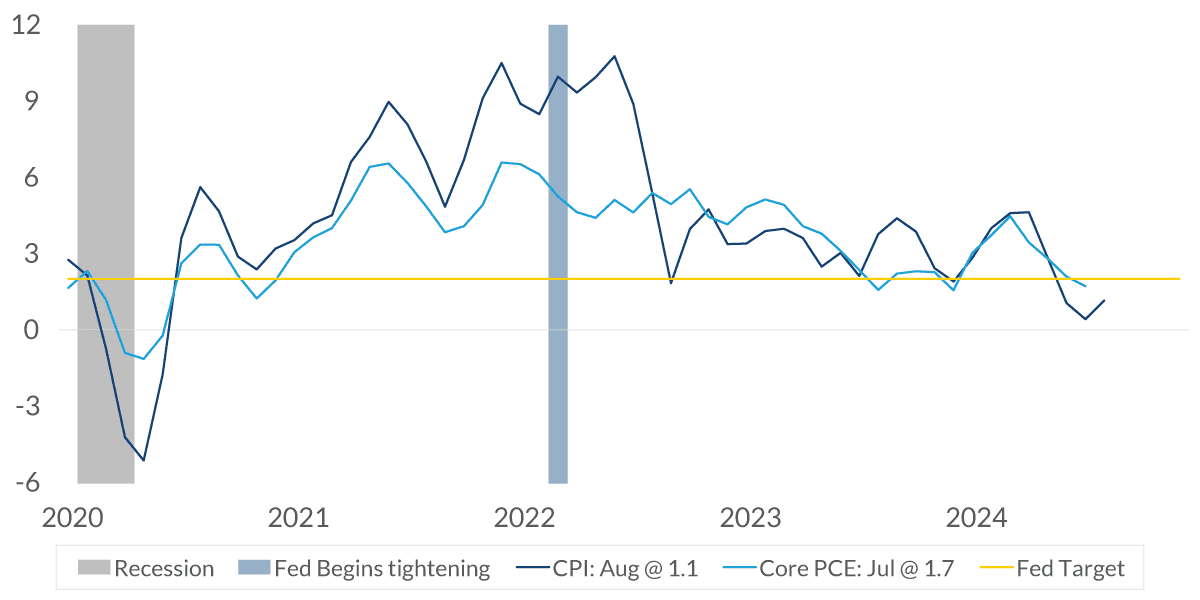

Chart 6: Inflation: CPI & Core PCE

%, 3-month annualized change, seasonally adjusted

Data current as of September 23, 2024

Sources: Bureau of Economic Analysis, Bureau of Labor Statistics

Information is subject to change and is not a guarantee of future results.

Chart 6, 4:45– This chart shows the annualized rate of the three-month change in CPI and Core PCE, which is the Fed’s preferred inflation measurement. Both are below the 2% target level.

Chart 7: FOMC Projections - GDP

%, y-o-y, historical data is seasonally adjusted annual rate

Data current as of September 23, 2024

Sources: The Federal Reserve Bank, Bureau of Economic Analysis

Information is subject to change and is not a guarantee of future results.

Chart 7, 4:57– This is the Fed’s expectation for GDP growth. It expects growth to be 2% for the next several years, a slightly slower pace than this past year’s 3.1%. Some of that may be due to the slower pace of hiring compared to the past few years and reduced pace of consumer spending. Both of these are classic events of a maturing expansion.

The economy is in good shape. According to the Atlanta Fed’s NowCast, GDP growth this quarter is expected to be 2.9%. So, the Fed is lowering interest rates before the economy’s weakness has a chance to set in. An aggressive approach to lowering interest rates is needed for the federal funds rate is very high.

Chart 8: Federal Funds Rate Minus the Neutral Rate

%, Holston-Laubach-Williams model for natural rate

Data current as of September 23, 2024

Sources: Federal Reserve Bank, Federal Reserve Bank of New York, Holston-Laubach-Williams model

Information is subject to change and is not a guarantee of future results.

Chart 8, 5:40– Probably, the best way of determining how restrictive or how easy monetary policy is is to take the federal funds rate and subtract the neutral rate from it. The neutral rate, which is sometimes called the natural rate, is the theoretical short-term interest rate that will support solid economic output while keeping inflation constant.

Sometimes it’s called the “Goldilocks” number because it’s the “just right” number, and as you can see, at 2.1%, it’s very high compared to history. The Fed’s planned interest rate cuts will bring it down very, very quickly.

Although the pace of hiring is on the low side of what the Fed probably wants, the economy is not stalling. GDP growth in the past year was a robust 3.1%. In this quarter, the third quarter, the Atlanta Fed expects economic growth to be 2.9% due to solid consumer spending.

With the jump-starting of the easing cycle with a 50 basis point cut and more cuts to follow, the Fed is proactively trying to ease the pressures off the economy to ensure that growth in the labor market reaccelerates.

The Fed expects that financing costs will decline, helping to keep investment strong, consumer spending high, and a bounce back in labor gains. It is insurance of a soft landing.

Important Information

The views expressed represent the opinions of City National Rochdale, LLC (CNR) which are subject to change and are not intended as a forecast or guarantee of future results. Stated information is provided for informational purposes only, and should not be perceived as personalized investment, financial, legal or tax advice or a recommendation for any security. It is derived from proprietary and non-proprietary sources which have not been independently verified for accuracy or completeness. While CNR believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimates, projections, and other forward-looking statements are based on available information and management's view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions which may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements.

Past performance or performance based upon assumptions is no guarantee of future results.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market.

City National Rochdale, LLC is an SEC-registered investment adviser and wholly-owned subsidiary of City National Bank. Registration as an investment adviser does not imply any level of skill or expertise. City National Bank is a subsidiary of the Royal Bank of Canada.

© 2024 City National Bank. All rights reserved.

NON-DEPOSIT INVESTMENT PRODUCTS ARE: • NOT FDIC INSURED •NOT BANK GUARANTEED •MAY LOSE VALUE

Stay Informed.

Get our Insights delivered straight to your inbox.

Put our insights to work for you.

If you have a client with more than $1 million in investable assets and want to find out about the benefits of our intelligently personalized portfolio management, speak with an investment consultant near you today.

If you’re a high-net-worth client who's interested in adding an experienced investment manager to your financial team, learn more about working with us here.