-

Fixed Income Perspectives

Bonds Ride Volatility Higher

August 2024

- Filename

- Fixed Income Perspectives AUGUST 2024.pdf

- Format

- application/pdf

TRANSCRIPT

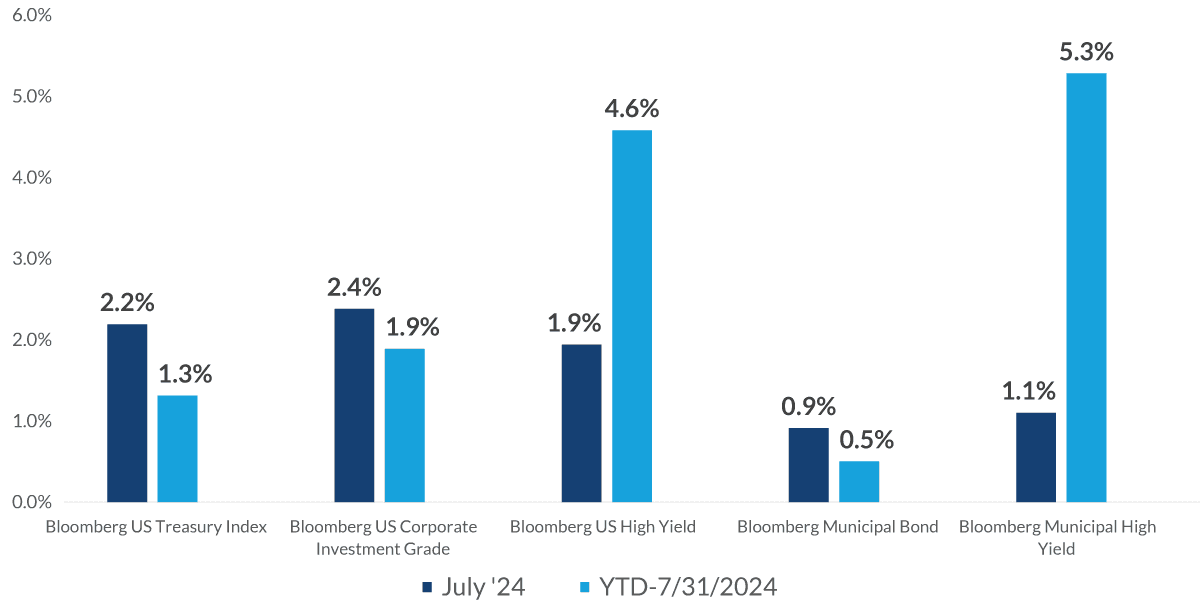

July was a strong month for bonds. Lower inflation readings and expected rate cuts around the corner combined to send treasury yields lower, and returns higher.

Total Return Across Fixed Income Asset Classes

Sources: Bloomberg, as of July 3, 2024. Information is not representative of any CNR product or service.

Indices are unmanaged, and one cannot invest directly in an index. Index returns do not reflect a deduction for fees or expenses. Information is subject to change and is not a guarantee of future results.

Index information: Intermediate US Treasury: Bloomberg U.S. Treasury Index, Bloomberg US Corporate Investment Grade Index, Bloomberg US High Yield Index, Bloomberg Municipal Bond Index, Bloomberg Municipal High Yield Index Leveraged Loans: Morningstar LSTA U.S. Leveraged Loan Index. Structured Credit: Palmer Square CLO BB Index.

Chart 1, 0:24– Looking across asset classes, treasury and corporate bond markets returned 2.2% and 2.4% – the largest monthly returns for the year. After a challenging year for the tax-exempt market, investment grade municipals returned just under 1% for the month, bringing the asset class into positive territory for the year.

High yield sectors of the market added to already strong performance, with U.S. high yield corporate bonds up 4.6%, and high yield municipal bonds up 5.3%, year-to-date. It's notable that even during periods of increased equity volatility, credit spreads remain low, and default rates are starting to trend lower, offering further support for the asset class. The Fed left rates unchanged at the July 31 FOMC meeting but signaled that rate cuts may be appropriate as soon as September.

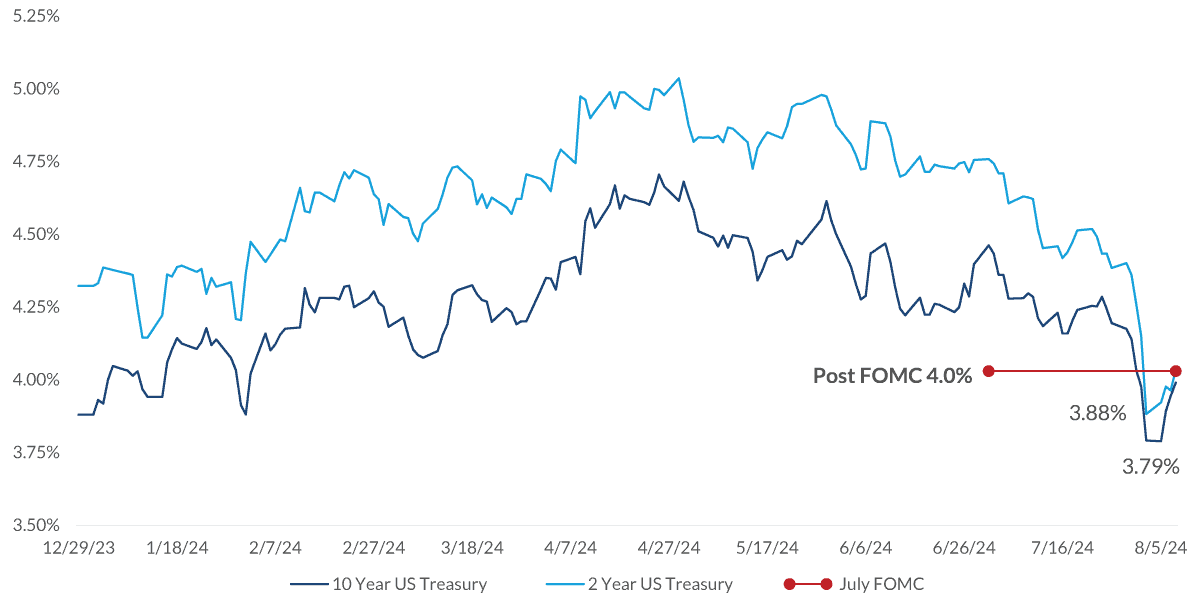

With rates already moving down after the FOMC meeting, the start of August has brought elevated volatility, with major movement in yields across the market.

US Treasury Yields

Source: Bloomberg as of 8/8/2024

Information is subject to change and is not a guarantee of future results

Chart 2, 1:24– A decline in July payroll data and an increase in unemployment of 4.3% on top of weaker-than-expected manufacturing data sparked a decline in yields.

Technical factors, which emerged from the unwind of the Japanese carry trade, also applied downward force on the level of yields. Two- and ten-year treasury yields declined by 34 and 24 basis points, respectively. However, as of the time of this recording, the treasury market has retraced much of the decline as the concerns over the unwind of the carry trade have eased, and incoming economic data suggests that the labor market remains on solid footing.

Economic Forecasts

Gross domestic product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period.

The Consumer Price Index (CPI) measures the monthly change in prices paid by US consumers.

e: estimate.

Sources: Bloomberg, proprietary opinions based on CNR Research, as of August 2024. Information is subject to change and is not a guarantee of future results.

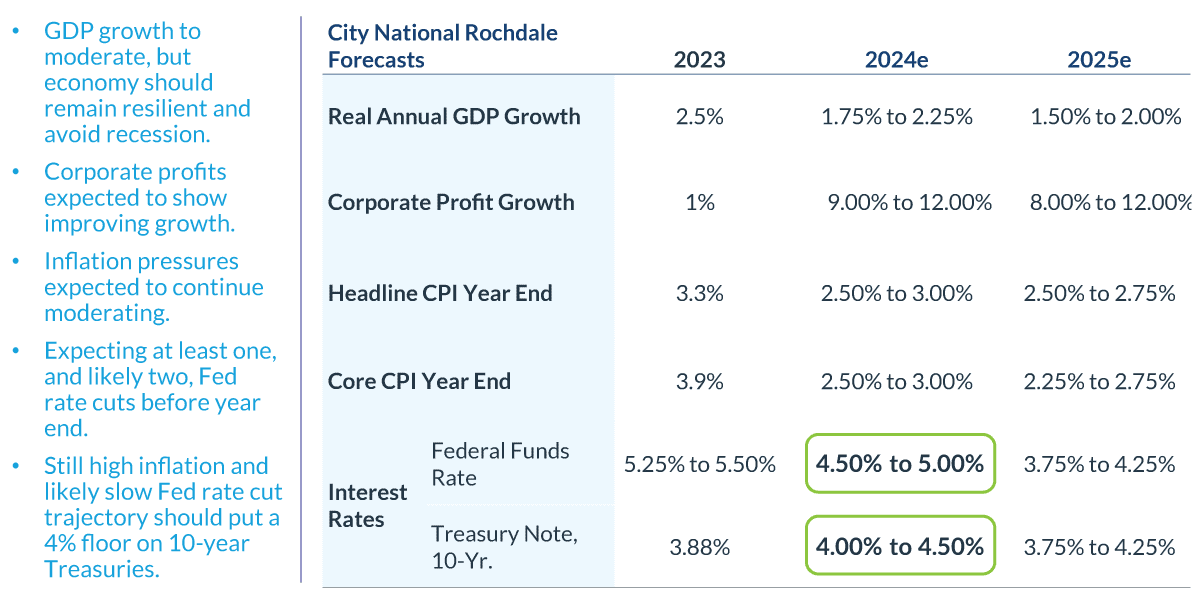

Chart 3, 2:01– It's important not to overreact to one data point. While the recent moves have been sharp, the economy is still growing, and it is transitioning back to its normal pace.

We believe the markets are too aggressive with respect to expectations for rate cuts, and we continue to expect the Fed to take a measured approach, with one to two rate cuts this year, although we do acknowledge that the probability of three cuts is higher. Additionally, we believe rates have peaked, but we expect the 10-year to be range-bound between 4% and 4.5% for the remainder of the year as technical pressure from supply will keep rates elevated.

Finally, the recent market swings are great reminders that long-term bonds may prove beneficial as the Fed begins its easing cycle, and short-term yields begin to decline.

Important Information

The views expressed represent the opinions of City National Rochdale, LLC (CNR) which are subject to change and are not intended as a forecast or guarantee of future results. Stated information is provided for informational purposes only, and should not be perceived as personalized investment, financial, legal or tax advice or a recommendation for any security. It is derived from proprietary and non-proprietary sources which have not been independently verified for accuracy or completeness. While CNR believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Actual results, performance or events may differ materially from those expressed or implied in such statements. All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met, and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance.

City National Rochdale, LLC is an SEC-registered investment adviser and wholly-owned subsidiary of City National Bank. Registration as an investment adviser does not imply any level of skill or expertise. City National Bank is a subsidiary of the Royal Bank of Canada. City National Bank provides investment management services through its subadvisory relationship with City National Rochdale. Brokerage services are provided through City National Securities, Inc., a wholly-owned subsidiary of City National Bank and Member FINRA/SIPC.

Fixed Income investing strategies & products. There are inherent risks with fixed income investing. These risks include, but are not limited to, interest rate, call, credit, market, inflation, government policy, liquidity or junk bond risks. When interest rates rise, bond prices fall. This risk is heightened with investments in longer-duration fixed income securities and during periods when prevailing interest rates are low or negative.

Index Definitions:

The Bloomberg Barclays US Intermediate Corporate Bond Index is a measure of the investment grade, fixed-rate, taxable corporate bond market. It includes USD-denominated securities publicly issued by US and non-US industrial, utility and financial issuers that have between 1 and up to, but not including, 10 years to maturity. The maturity range of the bonds included in the index is between 1 to 9.9999 years.

Bloomberg U.S. 1-15 Yr. Municipal Bond Index consists of a broad selection of investment grade general obligation and revenue bonds of maturities ranging from one year to 17 years.

Bloomberg Tax-Exempt HY is market value-weighted and designed to measure the performance of U.S. dollar-denominated high-yield municipal bonds issued by U.S. states, the District of Columbia, U.S. territories and local governments or agencies.

Bloomberg U.S. 6M Treasury Bill Index: The 6 Month Treasury Bill Rate is the yield received for investing in a US government issued treasury bill that has a maturity of 6 months.

The Bloomberg Barclays U.S. Corporate High Yield Index is an unmanaged, U.S.-dollar-denominated, nonconvertible, non-investment-grade debt index. The index consists of domestic and corporate bonds rated Ba and below with a minimum outstanding amount of $150 million.

Morningstar LSTA U.S. Leveraged Loan Index is designed to measure the performance of the 100 largest facilities in the US leveraged loan market.

Palmer Square CLO BB Index is a rules-based observable pricing and total return index for CLO debt sold in the United States, rated A, BBB or BB (or equivalent rating), i.e., mezzanine CLO debt.

© 2024 City National Rochdale, LLC. All rights reserved.

Stay Informed.

Get our Insights delivered straight to your inbox.

Put our insights to work for you.

If you have a client with more than $1 million in investable assets and want to find out about the benefits of our intelligently personalized portfolio management, speak with an investment consultant near you today.

If you’re a high-net-worth client who's interested in adding an experienced investment manager to your financial team, learn more about working with us here.